About

Learn approximately the esteemed legal professional F. Keats Boyd III and his full-size revel in in property planning law.

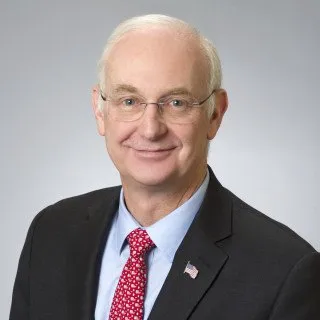

F. Keats Boyd III, a outstanding legal professional in Hyannis, Massachusetts, contains at the legacy of his father, F. Keats Boyd Jr., who founded Boyd & Boyd, P.C. Mr. Boyd III graduated cum laude from the College of the Holy Cross and acquired his law degree from Stanford University. With over 35 years of enjoy in property planning regulation, he has installed himself as a respected determine in the criminal community.

Admitted to the bar in Massachusetts, in addition to america Tax Court, US District Court of Massachusetts, the USA Court of Appeals, and the Supreme Court of the United States, Mr. Boyd III has a comprehensive understanding of the prison device. His know-how has been recognized with listings inside the “Bar Register of Preeminent Lawyers” and the best professional and ethical score in Martindale-Hubbell’s National Directory of Lawyers.

In 2012, Mr. Boyd III changed into venerated as one among Boston’s Top Rated Lawyers, and in 2013, he turned into recognized as one in every of New England’s pinnacle rated legal professionals in “Legal Leaders.” His determination to his practice brought about some other accolade in 2014, when he turned into another time named considered one of Boston’s Top Rated Lawyers in “Legal Leaders.”

A member of prestigious agencies along with the Greater Boston Estate Planning Council, the Estate Planning Council of Cape Cod, and the National Association of Estate Planners, Mr. Boyd III is committed to upholding the highest standards of legal professionalism. His affiliation with WealthCounsel® and the Barnstable Bar Association in addition demonstrates his dedication to his field.

Videos

Legal Issues

- Elder Law

- Estate Planning

- Guardianship & Conservatorship Estate Administration, Health Care Directives, Trusts, Wills

- Tax Law

- Business Taxes, Criminal Tax Litigation, Estate Tax Planning, Income Taxes, International Taxes, Payroll Taxes, Property Taxes, Sales Taxes, Tax Appeals, Tax Audits, Tax Planning

Certificates

No Certifications

Languages

- English: Spoken, Written

Accepted Jurisdictions

Experience

- Partner

Boyd & Boyd, P.C.

1990

Education

Graduation year: 1987">

Graduation year: 1979">

Associations

1990 - Current">

Costs

-

Free Consultancy Service

Free Initial Consultation - Payment With Credit Card

-

Retaines and Rates

Most estate planning rates are Flat Fee. Appropriate Planning techniques and fee arrangements are discussed in initial consultation. Estate planning fees generally start at $1500 with typical fees averaging around $5000 to $8500.